Withholding Tax Calculator 2025 Philippines. For example, you need to enter 30000 instead of 30,000 to calculate the values correctly. Use this income tax in the philippines calculator to help you quickly determine your income tax as a filipino citizen, your benefits contributions, and your net pay after tax and deductions.

Your average tax rate is 5.4% and your marginal tax rate is 2.0%. Hier tax caculator philippines 2025 is using bir income tax table as of 2025.

Use our philippines payroll calculator for the 2025 tax year to effortlessly calculate your net salary, income tax, social security contributions, and other deductions.

This bir tax calculator helps you easily compute your income tax, add up your monthly contributions, and give you your total net monthly income.

Withholding Tax Calculator 2025 Philippines Deonne Maxine, This bir train law tax calculator helps you effortlessly compute your income tax, add up your monthly statutory contributions, and give you your total monthly net pay. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Tax Bracket Philippines 2025 Desiri Beitris, Dive in for expert tips and strategies! Your average tax rate is 5.4% and your marginal tax rate is 2.0%.

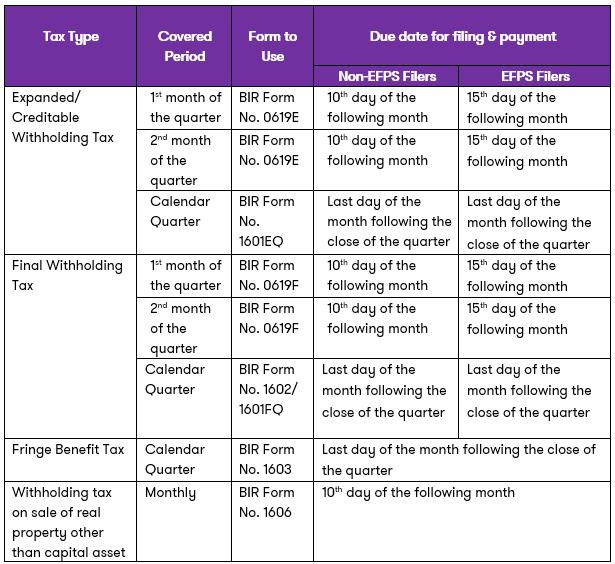

How to compute tax in the Philippines, To access withholding tax calculator click here. With our calculator, you can get an estimate of your income tax obligations and prepare your compliance with only a few clicks.

READ BIR issues revenue circular governing the new withholding tax, If you make ₱ 202,024 a year living in philippines, you will be taxed ₱ 10,841. This marginal tax rate means that your immediate additional income will be taxed at this rate.

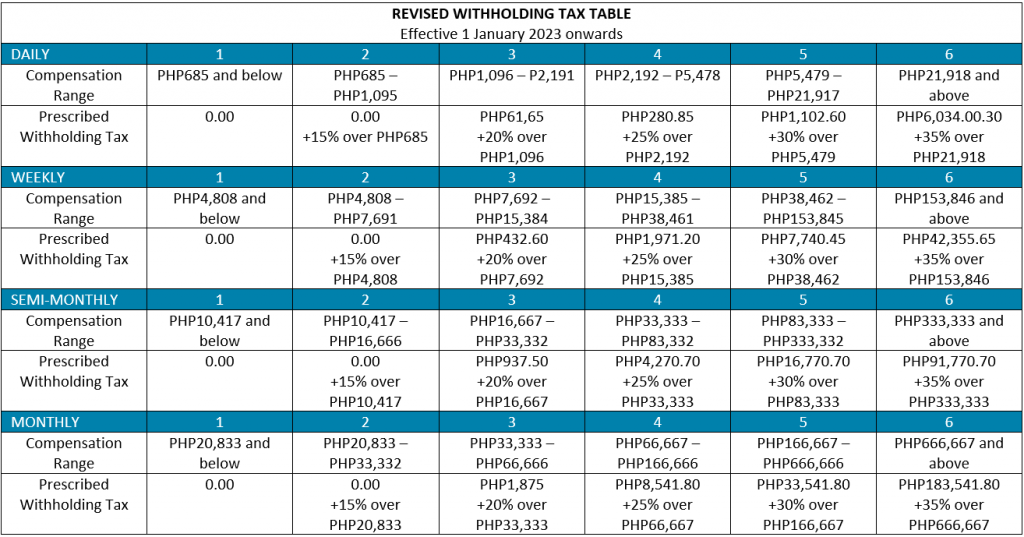

TRAIN Series Part 4 Amendments to Withholding Tax Regulations, Use the tax calculator philippines to locate your income bracket and corresponding tax rate. Subtract the calculated income tax (withholding tax) from your salary to get your net pay.

Updated Rules on the Filing and Payment of Withholding Tax Grant Thornton, For example, you need to enter 30000 instead of 30,000 to calculate the values correctly. Optional benefits and other cost to consider.

Annual Withholding Tax Table 2017 Philippines Review Home Decor, The transaction, which took place on july 2, 2025, involved the sale of 1,703 shares. Do not add a comma when inputting values.

How To Compute The Withholding Tax What Is Annualized vrogue.co, The philippines tax calculator below is for the 2025 tax year, the calculator allows you to calculate income tax and payroll taxes and deductions in philippines. The tax tables below include the tax rates, thresholds and allowances included in the philippines tax calculator 2025.

2025 Tax Table Philippines Latest News Update, If you make ₱ 202,024 a year living in philippines, you will be taxed ₱ 10,841. Subtract the calculated income tax (withholding tax) from your salary to get your net pay.

Revised Withholding Tax Table Bureau of Internal Revenue, The philippines tax calculator below is for the 2025 tax year, the calculator allows you to calculate income tax and payroll taxes and deductions in philippines. Subtract the calculated income tax (withholding tax) from your salary to get your net pay.

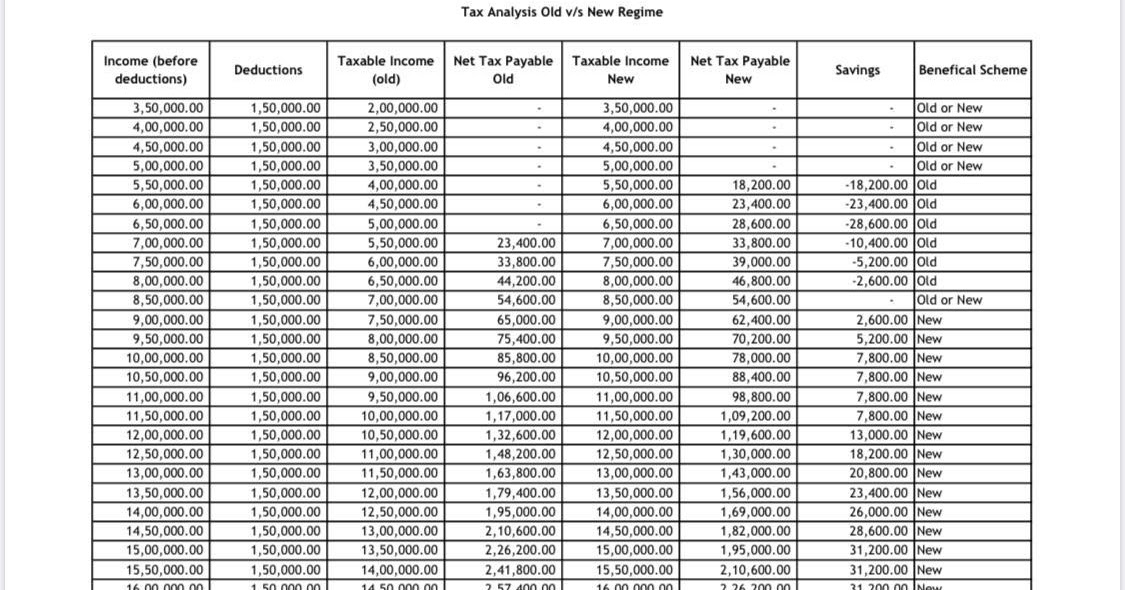

Individual tax rates 2025 philippines image to u, use this income tax in the philippines calculator to help.