What Is The Fsa Limit For 2025 Family. Amounts contributed are not subject to federal income tax, social security tax or medicare tax. The 2025 fsa contributions limit has been raised to $3,200 for employee contributions (compared to $3,050 in 2025).

The internal revenue service (irs) announced new cola adjustments and maximum fsa contribution limits for 2025. An employee who chooses to participate in an fsa can contribute up to $3,200 through payroll deductions during the 2025 plan year.

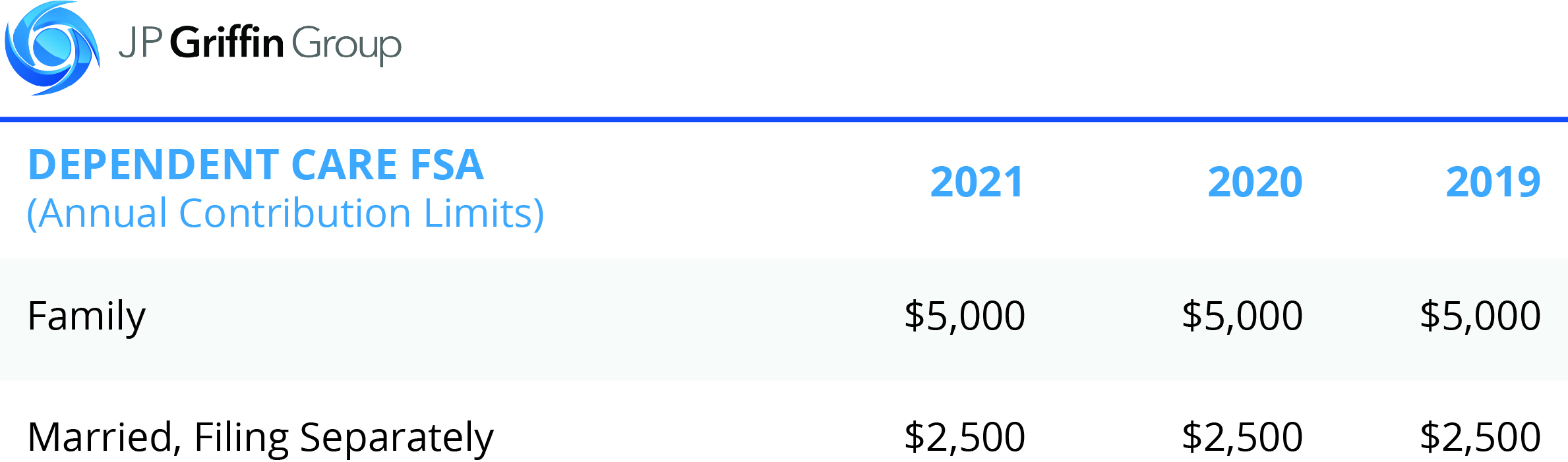

2025 Fsa And Hsa Lim … Romy Vivyan, Amounts contributed are not subject to federal income tax, social security tax or medicare tax. For 2025, as in 2025, the dependent care fsa limit is $5,000 for single filers and couples filing jointly, and $2,500.

Irs Dependent Care Fsa Limits 2025 Nissa Leland, The monthly commuter benefits limit in 2025 for mass transit and parking is $315 per month. What is the dependent care fsa limit for 2025?

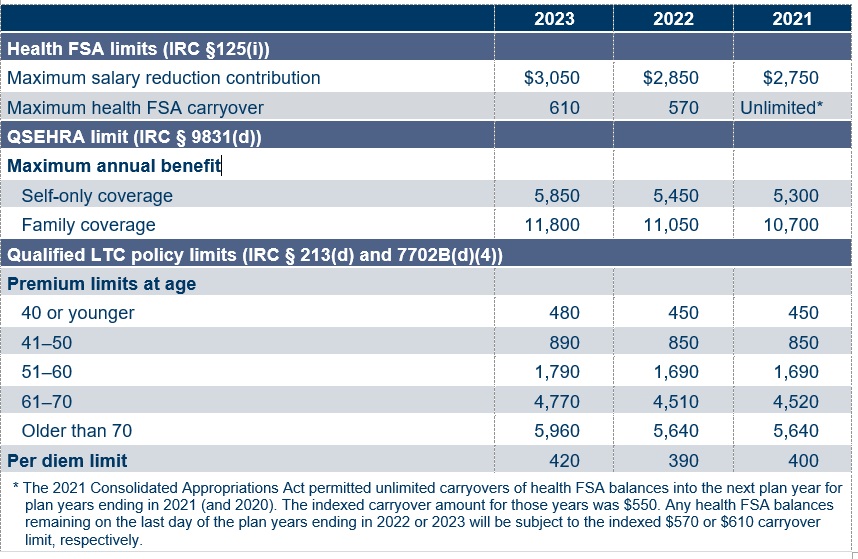

Dependent Care Fsa Limit 2025 Limit Over 65 Tresa Harriott, Individuals can contribute up to $4,150 to their hsa accounts for 2025, and families can contribute up to $8,300. The adjustment for 2025 represents a $150 increase to the current $3,050 health fsa salary reduction contribution limit in 2025.

Fsa Maximum 2025 Family Arlee Cacilia, The health fsa limit is $3,200 per employee in 2025, regardless of family members benefiting from the funds. Workers can contribute to tax.

What You Need to Know About the Updated 2025 Health FSA Limit DSP, Employees can now contribute $150 more. These amounts are approximately 7% higher than.

Fsa Limit 2025 Uta Zorana, The health fsa limit is $3,200 per employee in 2025, regardless of family members benefiting from the funds. The limit on health fsa carryovers increases to $640 for plan years beginning in 2025.

Irs Fsa Max 2025 Joan Ronica, What is the 2025 maximum fsa contribution? Irs increases fsa limits for 2025.

What You Need to Know About the Updated 2025 Health FSA Limit DSP, Irs increases fsa limits for 2025. The contribution limit is set by the.

2025 Dependent Care Fsa Emmie Isadora, Amounts contributed are not subject to federal income tax, social security tax or medicare tax. Individuals can contribute up to $4,150 to their hsa accounts for 2025, and families can contribute up to $8,300.

2025 Fsa Limits Perla Kristien, But if you have an fsa in 2025, here are the maximum amounts you can contribute for 2025 (tax returns normally filed in 2025). An employee who chooses to participate in an fsa can contribute up to $3,200 through payroll deductions during the 2025 plan year.

:max_bytes(150000):strip_icc()/dotdash-hsa-vs-fsa-v3-66871b956baa4be786d2138777e70067.jpg)

For 2025, as in 2025, the dependent care fsa limit is $5,000 for single filers and couples filing jointly, and $2,500.